Some Known Factual Statements About Bank Statement

Wiki Article

Bank Reconciliation Things To Know Before You Get This

Table of ContentsFascination About Bank StatementThe Greatest Guide To Bank ReconciliationNot known Details About Bank Certificate The Greatest Guide To Bank Reconciliation

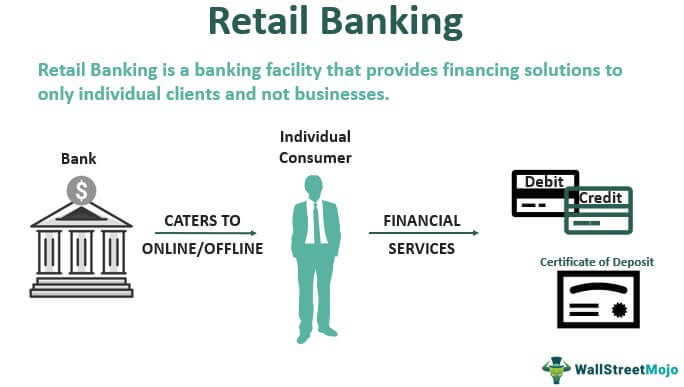

You can likewise save your money as well as make interest on your investment. The cash stored in most checking account is government guaranteed by the Federal Deposit Insurance Company (FDIC), approximately a restriction of $250,000 for individual depositors as well as $500,000 for jointly held down payments. Banks also offer credit rating possibilities for people and also companies.

Banks earn a profit by charging even more interest to borrowers than they pay on interest-bearing accounts. A financial institution's dimension is established by where it is located and also who it servesfrom tiny, community-based establishments to large business financial institutions. According to the FDIC, there were simply over 4,200 FDIC-insured commercial financial institutions in the United States since 2021.

Typical banks use both a brick-and-mortar area as well as an on-line presence, a brand-new pattern in online-only banks emerged in the early 2010s. These banks typically provide customers greater rate of interest and also lower costs. Comfort, interest prices, and also costs are several of the elements that assist customers determine their preferred financial institutions.

3 Simple Techniques For Bank Draft Meaning

The regulative environment for financial institutions has since tightened substantially as an outcome. United state banks are regulated at a state or nationwide level. State financial institutions are regulated by a state's division of financial or department of economic institutions.

A community financial institution, for example, takes down payments and offers in your area, which can use a much more personalized financial relationship. Choose a hassle-free area if you are selecting a bank with a brick-and-mortar location. If you have a financial emergency, you do not wish to need to take a trip a far away to get cash money.

The smart Trick of Bank Draft Meaning That Nobody is Talking About

Some financial institutions likewise use mobile phone apps, which can be valuable. Check the fees connected with the accounts you want to open up. Financial institutions charge passion on lendings along with month-to-month upkeep charges, overdraft account fees, and cord transfer charges. Some large financial institutions are relocating to finish overdraft account charges in 2022, to ensure that might be a crucial consideration.Financing & Development, March 2012, Vol (bank reconciliation). 49, No. 1 Establishments that match up savers as well as debtors help guarantee that economic situations work efficiently YOU'VE got $1,000 you do not require for, say, a year and also intend to gain revenue from the cash until then. Or you get redirected here desire to acquire a home and need to obtain $100,000 and pay it back over 30 years.

That's where banks can be found in. Although banks do several things, their key role is to absorb fundscalled depositsfrom those with money, pool them, as well as provide them to those who need funds. Financial institutions are middlemans between depositors (who lend cash to the bank) as well as customers (to whom the bank provides money).

Down payments can be offered on demand (a monitoring account, for example) or with some constraints (such as financial savings and also time deposits). While at any kind of provided moment some depositors need their cash, many do not.

Excitement About Bank Account

The process includes maturity transformationconverting temporary responsibilities (deposits) to long-term assets (loans). Banks pay depositors less than they receive from customers, as well as that difference make up the mass of banks' earnings in most countries. Banks can complement conventional deposits as a resource of financing by directly borrowing in the cash and also capital markets.

Banks maintain those called for gets on down payment with reserve banks, such as the United State Federal Book, the Financial Institution of Japan, and the European Central Bank. Financial institutions develop cash when they offer the remainder of the cash depositors offer them. This money can be used to buy items as well as services as well as can discover its method back right into the financial system as a deposit in one more financial institution, which then can lend a portion of it.

The dimension of the multiplierthe amount of money created from a preliminary depositdepends on the quantity of cash banks need to banking keep reserve (bank account). Banks additionally offer as well as reuse excess cash within the economic system as well as create, disperse, and also trade safeties. Banks have several ways of generating income besides pocketing the distinction (or spread) between the interest they pay on deposits and obtained money and also the rate of interest they gather from borrowers or safeties they hold.

Report this wiki page